We believe investing powers each fund and aim to increase diversity of ideas and reduce volatility of investors funds!

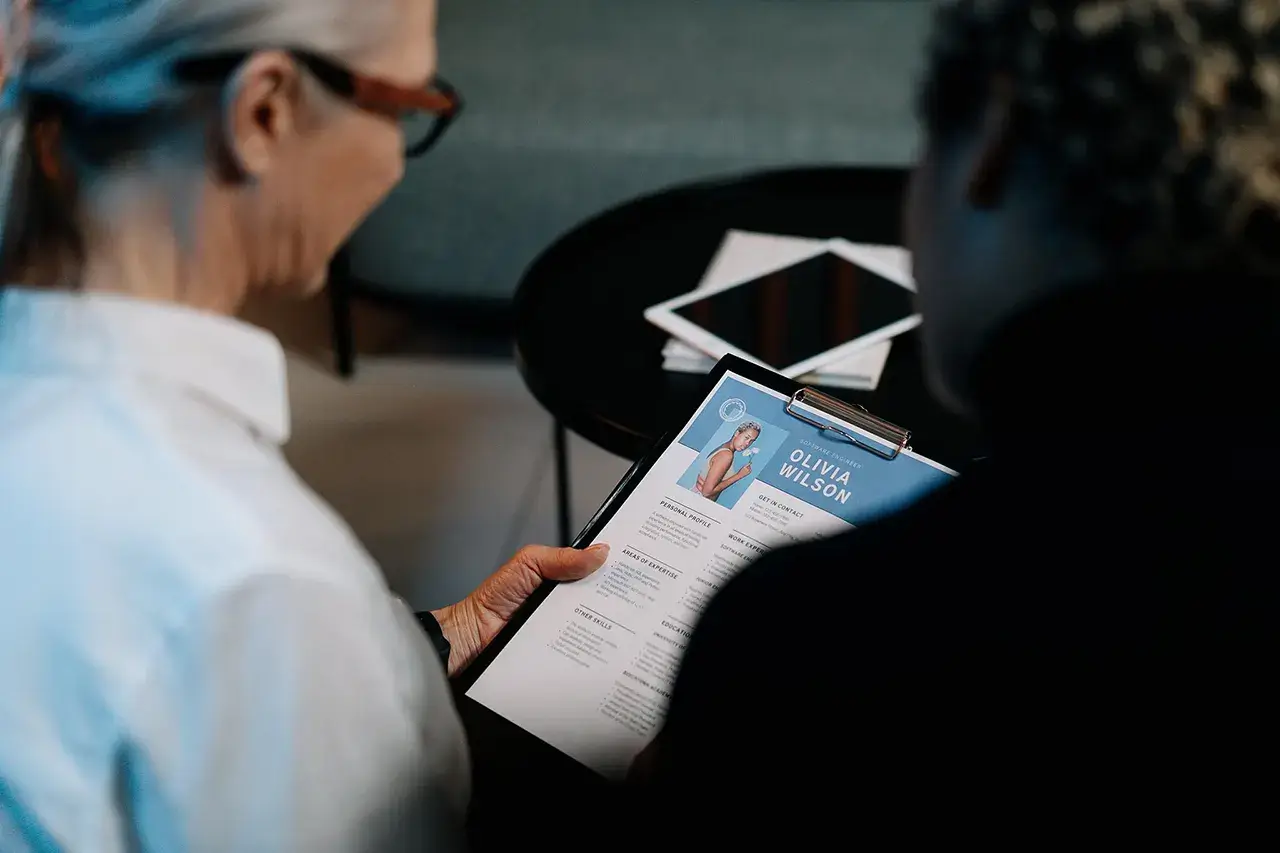

Our research is more than just numbers. Year over year, we get to know the people who make the company work.

We keeping close contact with our management and spending time on location, drive a deep operational understanding.

We keeping close contact with our management and spending time on location, drive a deep operational understanding.